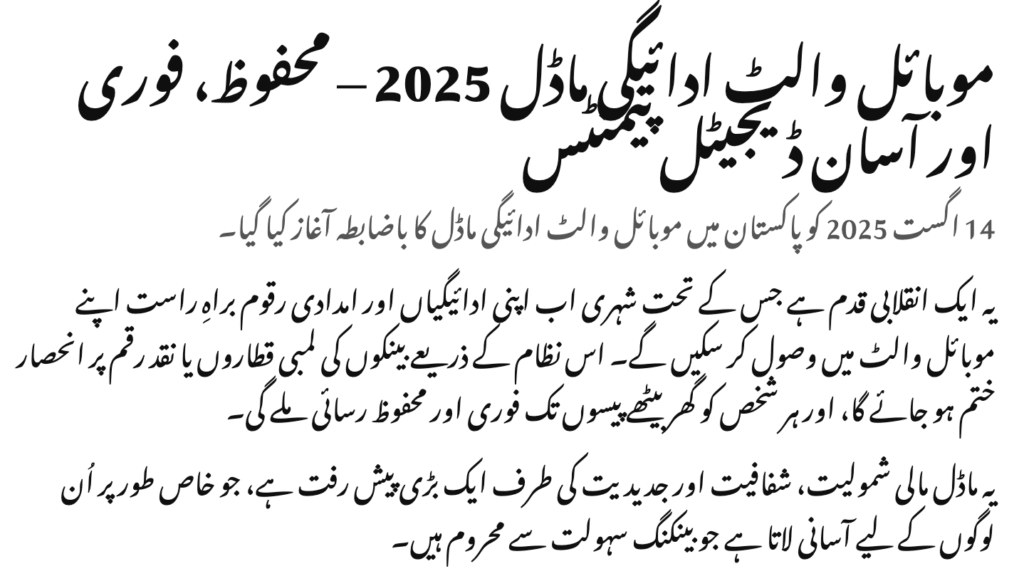

On 14 August 2025, Pakistan officially launched the Mobile Wallets Payment Model, a groundbreaking step in transforming the way citizens receive and manage money. Instead of waiting in long queues at banks or relying on cash handouts, beneficiaries can now receive payments directly in their mobile wallets—anytime, anywhere.

This initiative is designed to promote financial inclusion, transparency, and efficiency, ensuring that millions of unbanked individuals can access digital financial services without depending on traditional banking systems.

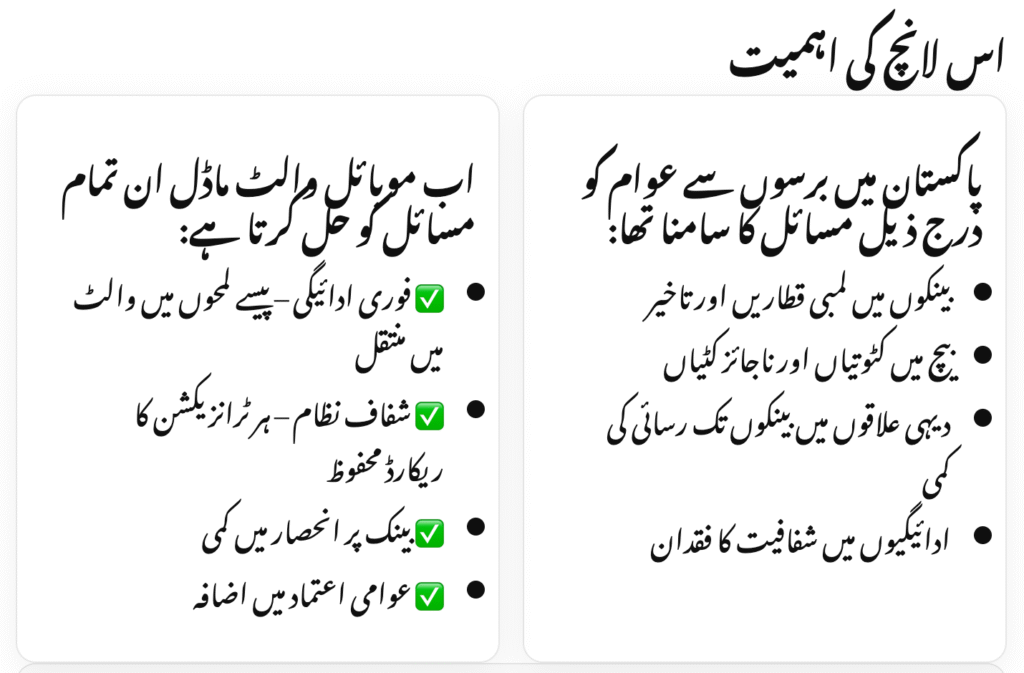

Why This Launch is Important

For years, people—especially in rural and low-income areas—faced challenges like:

- Long delays in receiving funds

- Unnecessary deductions by middlemen

- Limited access to banks

- Lack of transparency in payments

The new Mobile Wallet Payment System directly addresses these issues by offering:

- Instant access to money

- Secure and transparent digital records

- Reduced dependency on banks

- Direct link between citizens and welfare programs

Launching this model on Independence Day was symbolic—marking a step toward economic freedom and digital independence for the nation.

What is a Mobile Wallet?

A mobile wallet is a digital account on your phone that works like a pocket-sized bank. With it, you can:

- Receive payments instantly

- Pay bills, groceries, and services

- Send money to family or friends

- Withdraw cash through agents or ATMs

- Track all transactions digitally

Many mobile wallets work without internet via USSD codes, making them accessible even in areas with weak connectivity.

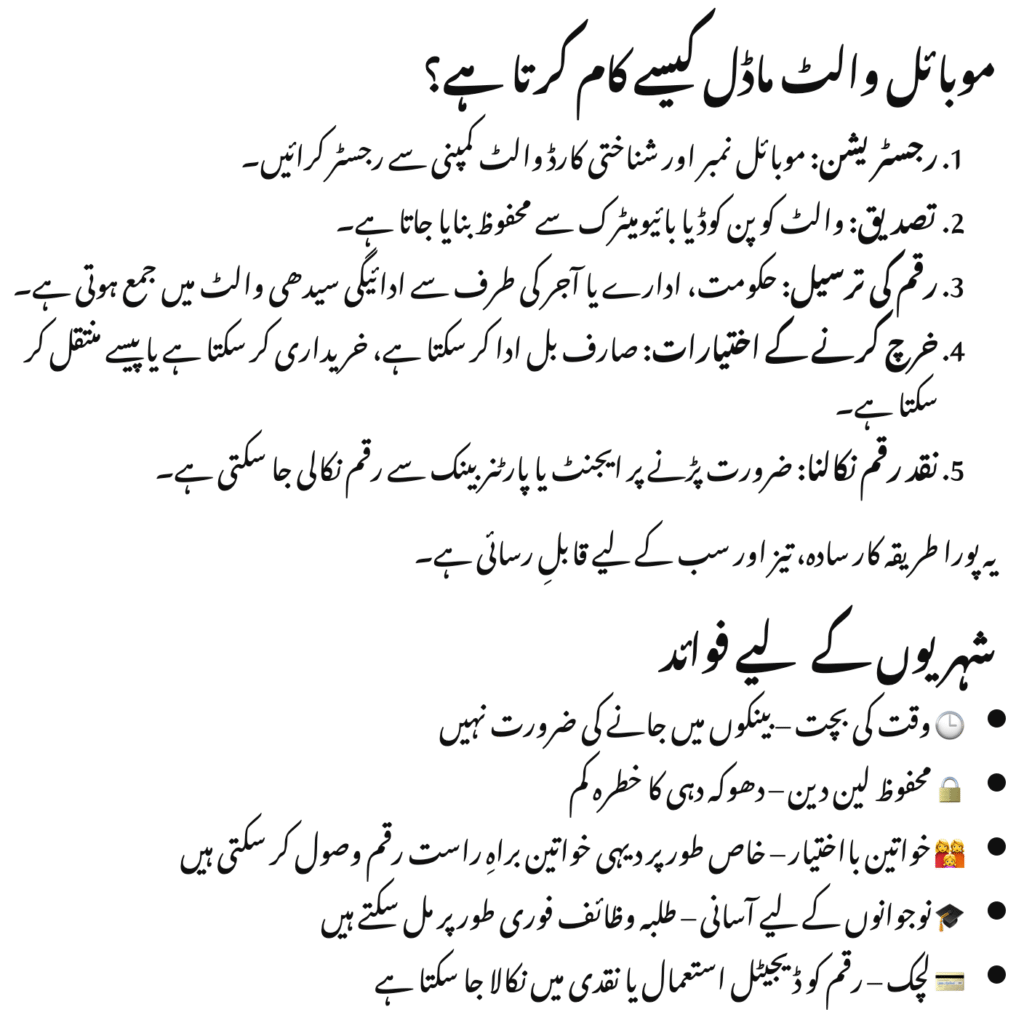

How the Mobile Wallet System Works

- Registration: Link your mobile number and CNIC/ID to a wallet provider

- Verification: Secure with PIN or biometric authentication

- Direct Deposit: Payments from government, employers, or private senders land directly in the wallet

- Spending Options: Pay bills, shop, or transfer money instantly

- Cash Withdrawal: Withdraw funds from partner banks or local agents

This process ensures simplicity, speed, and accessibility, especially for those previously excluded from financial services.

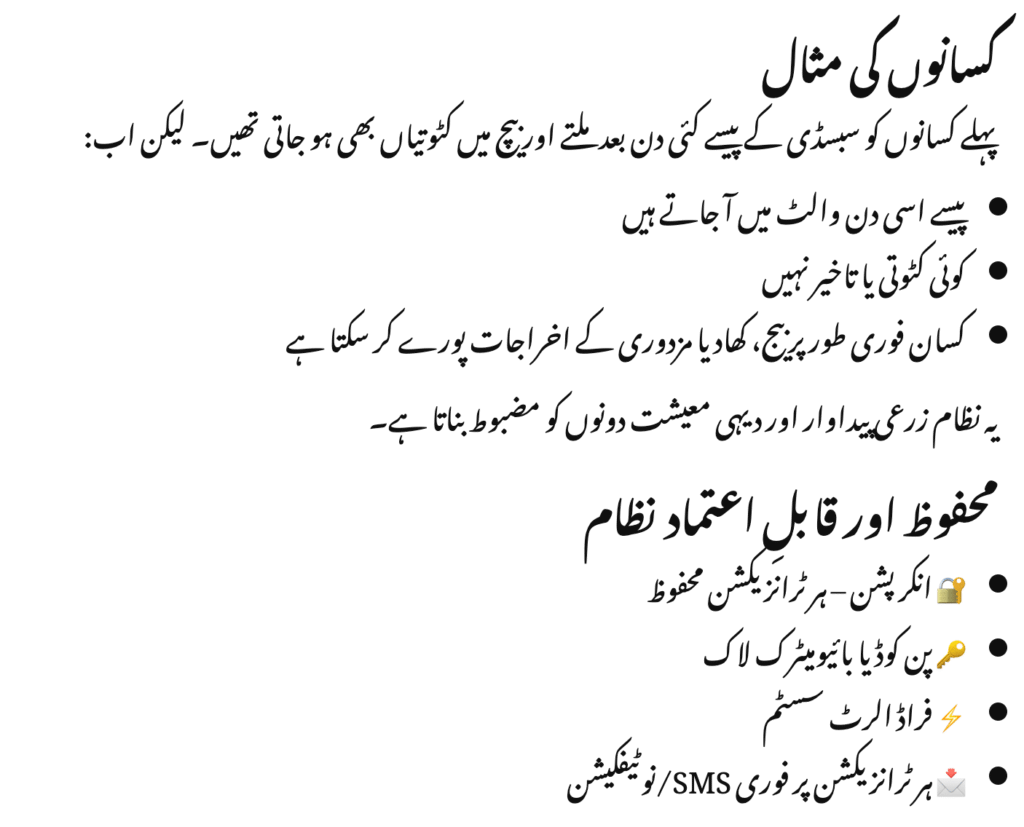

Real-Life Example: Farmers Relief

Before digital wallets, farmers waited weeks for subsidies and faced deductions by middlemen. Now:

- Payments arrive the same day

- No hidden cuts or delays

- Funds can be used immediately for seeds, fertilizers, or wages

This boosts agriculture productivity and strengthens rural economies.

Security & Trust Features

The system prioritizes safety and user trust through:

- Encryption for all transactions

- PINs and biometrics for identity verification

- Fraud detection alerts for suspicious activity

- Instant SMS/app notifications after every transaction

Financial Inclusion: Bridging the Gap

Millions of unbanked citizens now have access to:

- Digital accounts via mobile phones

- Direct welfare payments and subsidies

- Savings, credit, and insurance in the future

- Reduced corruption from cash-based systems

This is a historic step toward narrowing the urban-rural financial gap.

Global Success Stories

Mobile wallets have transformed economies worldwide:

- Kenya (M-Pesa): Lifted millions out of poverty

- China (Alipay & WeChat Pay): Daily digital payments revolutionized lifestyles

- India (UPI): Billions of secure transactions monthly

- Europe (Wero Wallet): Cross-border payments across the EU

Pakistan now joins this global movement, aligning itself with digital financial progress.

FAQs

Do I need internet?

Not always—USSD codes allow offline transactions.

What if I lose my phone?

Wallets can be blocked and restored using CNIC verification.

Can I send money abroad?

Currently, local transfers are supported. International remittances may come in future phases.

Are there fees?

Basic services are free; small charges may apply on withdrawals or transfers.

Who can use it?

Anyone with a valid CNIC and mobile number.

Conclusion

The Mobile Wallets Payment Model 2025 is a revolutionary step for Pakistan’s financial system. By giving citizens instant, secure, and transparent access to money, it empowers farmers, women, students, and small business owners alike.

This model reduces dependency on cash, improves trust in government programs, and places financial power directly in people’s hands.

In short, a mobile wallet is more than an app—it is Pakistan’s gateway to digital independence and inclusive economic growth.